Mcminn County Property Appraiser

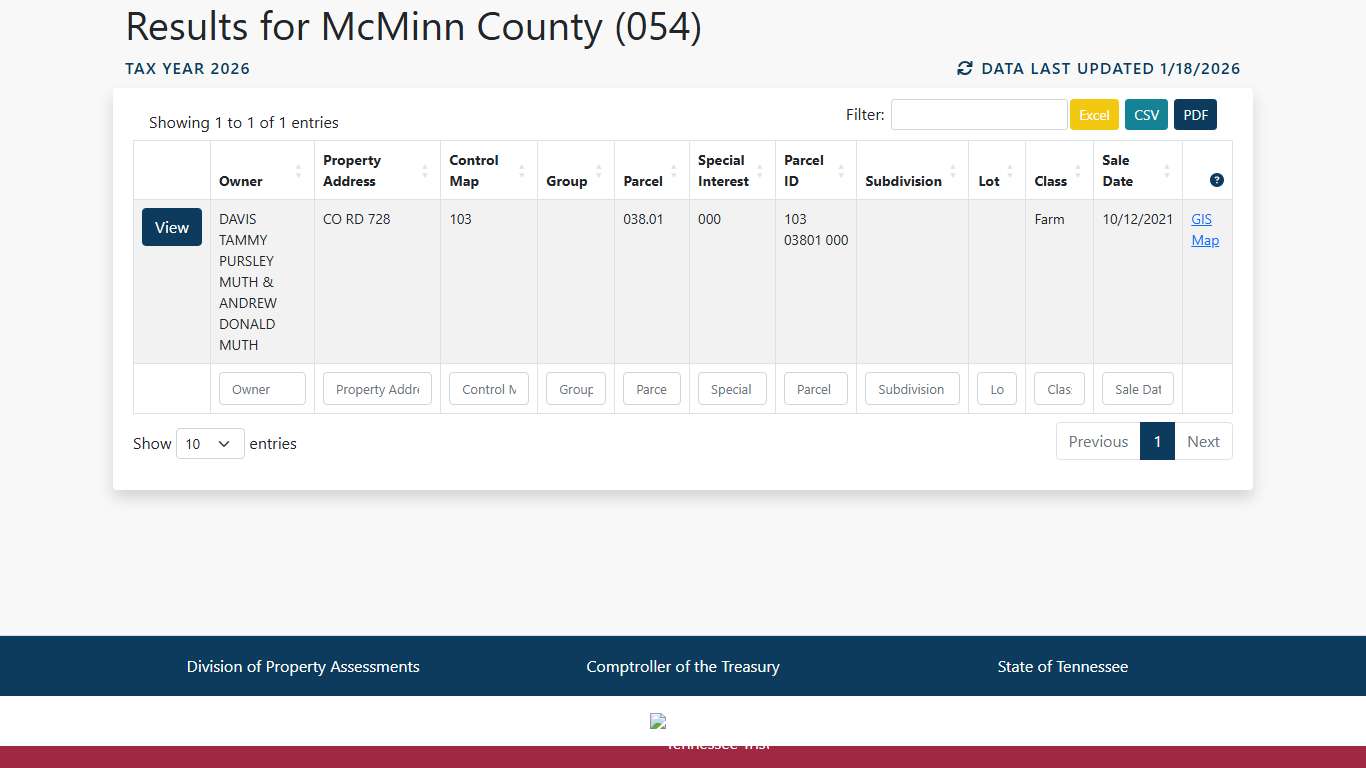

Tennessee Property Assessment Data Search Results

Results for McMinn County (054) Tax Year 2026 Data Last Updated 1/18/2026 Showing 1 to 1 of 1 entries...

https://assessment.cot.tn.gov/TPAD/Search?serializedParameters=%7B%22Jur%22%3A%22054%22,%22PropertyAddress%22%3A%22%22,%22SubdivisionName%22%3A%22%22,%22Query%22%3A%22%22,%22Owner%22%3A%22%22,%22PropertyType%22%3A%22%22,%22SortBy%22%3A%22Owner%22,%22SaleDateRangeStart%22%3A%22%22,%22SaleDateRangeEnd%22%3A%22%22,%22ControlMap%22%3A%22103%20%20%22,%22MapGroup%22%3A%22%20%20%22,%22ParcelNumber%22%3A%2203801%22,%22GISLink%22%3A%22054103%20%20%20%2003801%22%7D

Property Tax Notices were mailed on September 10, 2025

All property taxes are due by February 28, 2026. For more information, please contact the Finance Office of the City of Athens at 423-744-2710.

https://cityofathenstn.com/2025/09/12/public-notice-property-tax-notices/Tennessee Property Assessment Data Parcel Details

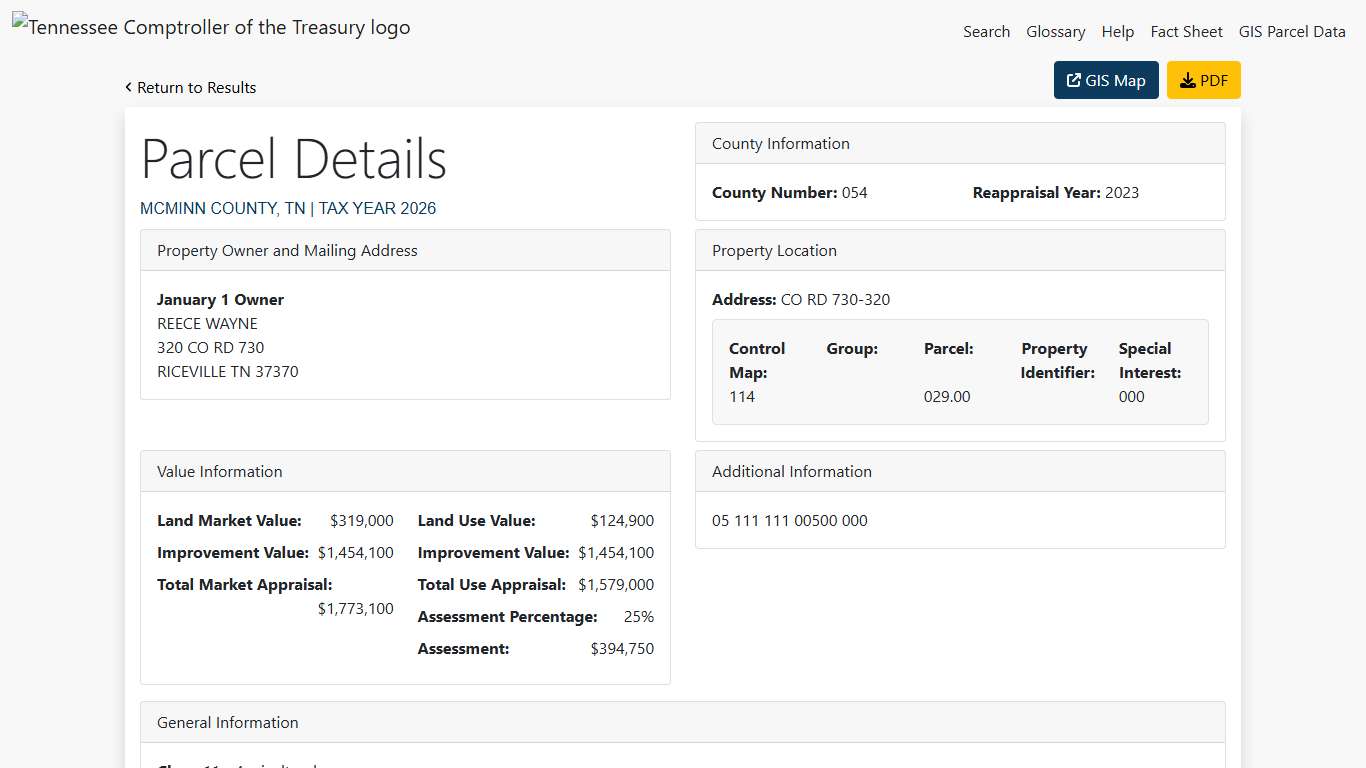

Parcel Details Address: CO RD 730-320 Land Market Value: $319,000 Improvement Value: $1,454,100 Total Market Appraisal: $1,773,100 Land Use Value: $124,900 Improvement Value: $1,454,100 Total Use Appraisal:$1,579,000 Assessment Percentage:25% Assessment: $394,750 Class: 11 - Agricultural City #: Special Service District 1: 000 District: 05 Number of buildings: 2 Utilities - Water/Sewer: 11 - INDIVIDUAL / INDIVIDUAL Utilities - Gas/Gas Type: 00...

https://assessment.cot.tn.gov/TPAD/Parcel/GIS?gislink=054114%20%20%20%2002900

Property Tax

You can now pay your taxes online or by phone 24 hours a day, 7 days a week! Simply click HERE or call us at 931-473-1200 anytime. Of course, you can also pay your taxes in person at City Hall (101 E.

https://www.mcminnvilletn.gov/departments/administration/finance/property_tax.php

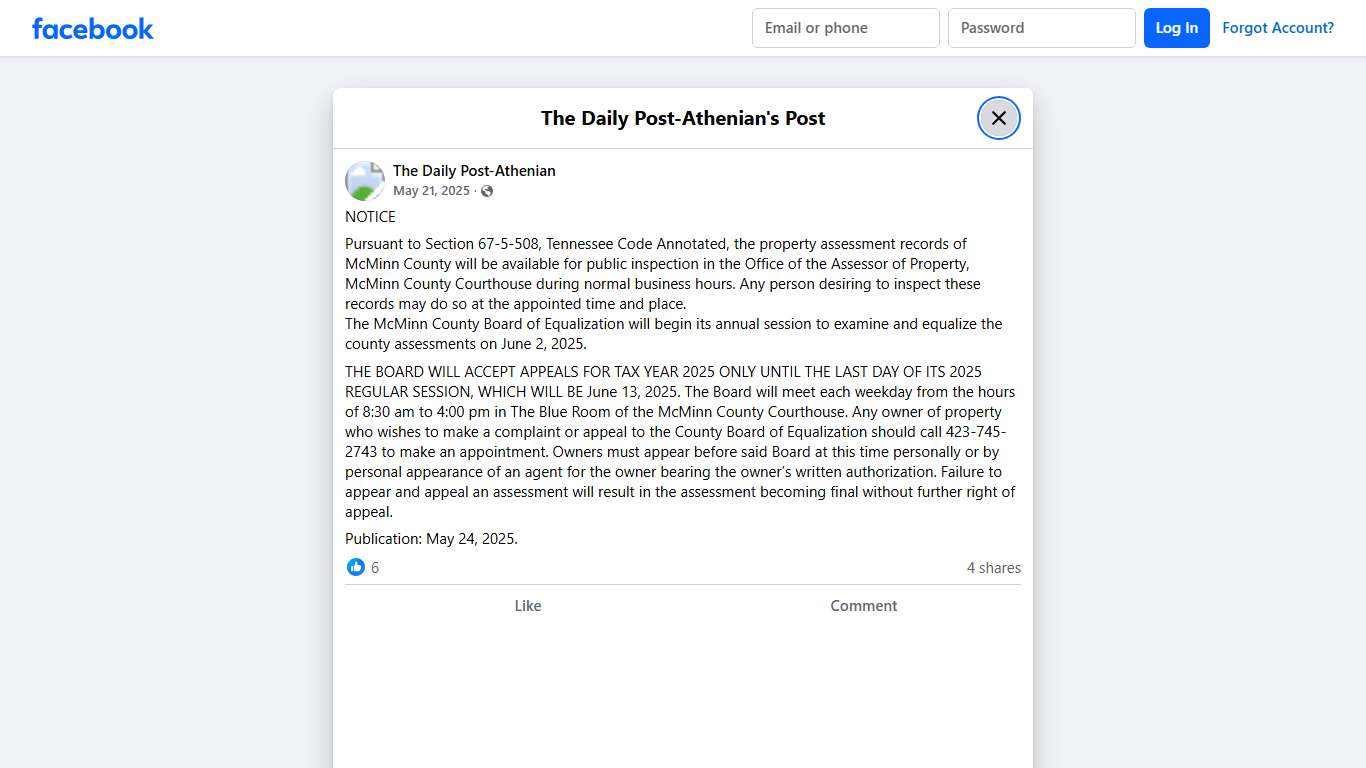

NOTICE Pursuant to Section... - The Daily Post-Athenian Facebook

Pursuant to Section 67-5-508, Tennessee Code Annotated, the property assessment records of McMinn County will be available for public inspection in the Office of the Assessor of Property, McMinn County Courthouse during normal business hours. Any person desiring to inspect these records may do so at the appointed time and place.

https://www.facebook.com/dailypostathenian/posts/noticepursuant-to-section-67-5-508-tennessee-code-annotated-the-property-assessm/1297535715604827/

Tennessee Prohibit State Property Taxes Amendment (2026)

[{"message":"You are not authorized to access this content without a valid TollBit Token. Please follow this URL to find out more.","url":"https://tollbit.dev"}]...

https://ballotpedia.org/Tennessee_Prohibit_State_Property_Taxes_Amendment_(2026)McMinn County, TN Property Tax Calculator 2025-2026

Calculate Your McMinn County Property Taxes McMinn County Tax Information How are Property Taxes Calculated in McMinn County? Property taxes in McMinn County, Tennessee are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.40% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/tennessee/mcminn-county

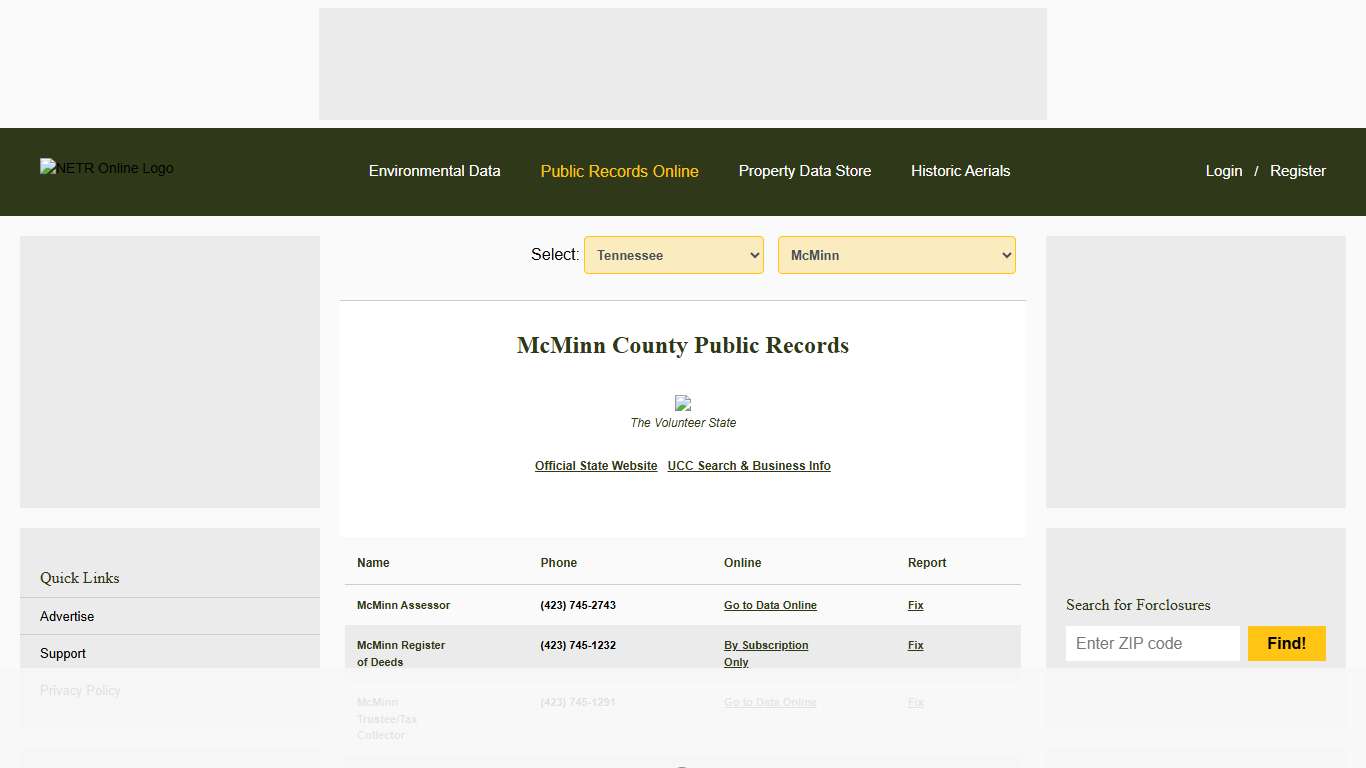

NETR Online • McMinn • McMinn Public Records, Search McMinn Records, McMinn Property Tax, Tennessee Property Search, Tennessee Assessor

Select: McMinn County Public Records The Volunteer State McMinn Assessor (423) 745-2743 McMinn Register of Deeds (423) 745-1232 McMinn Trustee/Tax Collector (423) 745-1291 McMinn NETR Mapping and GIS Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store Comparable Properties Reports...

https://publicrecords.netronline.com/state/TN/county/mcminn

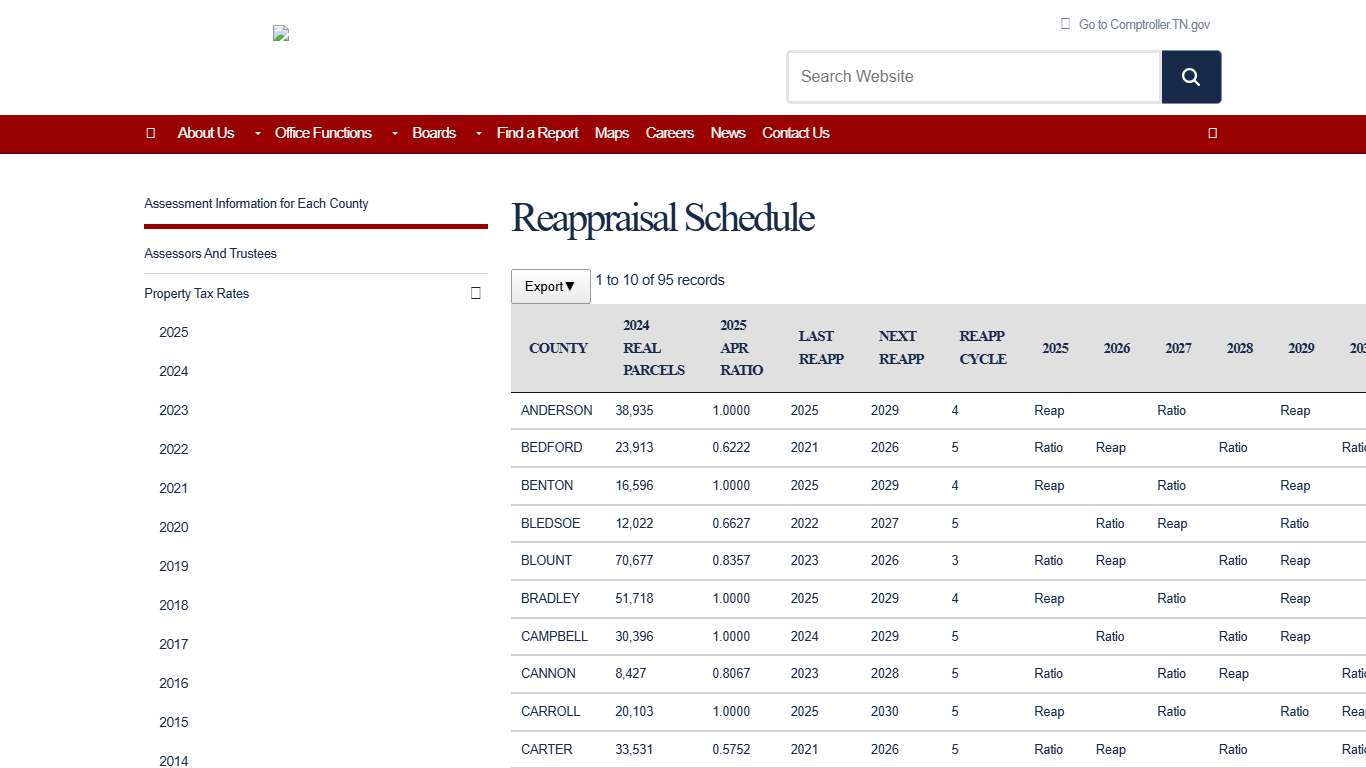

Reappraisal Schedule

Reappraisal Schedule ; ANDERSON, 38,935, 1.0000, 2025, 2029 ; BEDFORD, 23,913, 0.6222, 2021, 2026 ; BENTON, 16,596, 1.0000, 2025, 2029 ...

https://comptroller.tn.gov/office-functions/pa/tax-resources/assessment-information-for-each-county/reappraisal-schedule.html

Monroe-Macon Reporter Monroe County commissioners raise property taxes, in this week's Reporter .. Facebook

Just what we needed in this economy. People on a fixed incomes are already struggling and they add to it. Hope they remember this when election time comes around. Needs to be put on the ballot along with term limits. All of this don’t sound too bad!

https://www.facebook.com/groups/mcreporter/posts/10161876023201914/

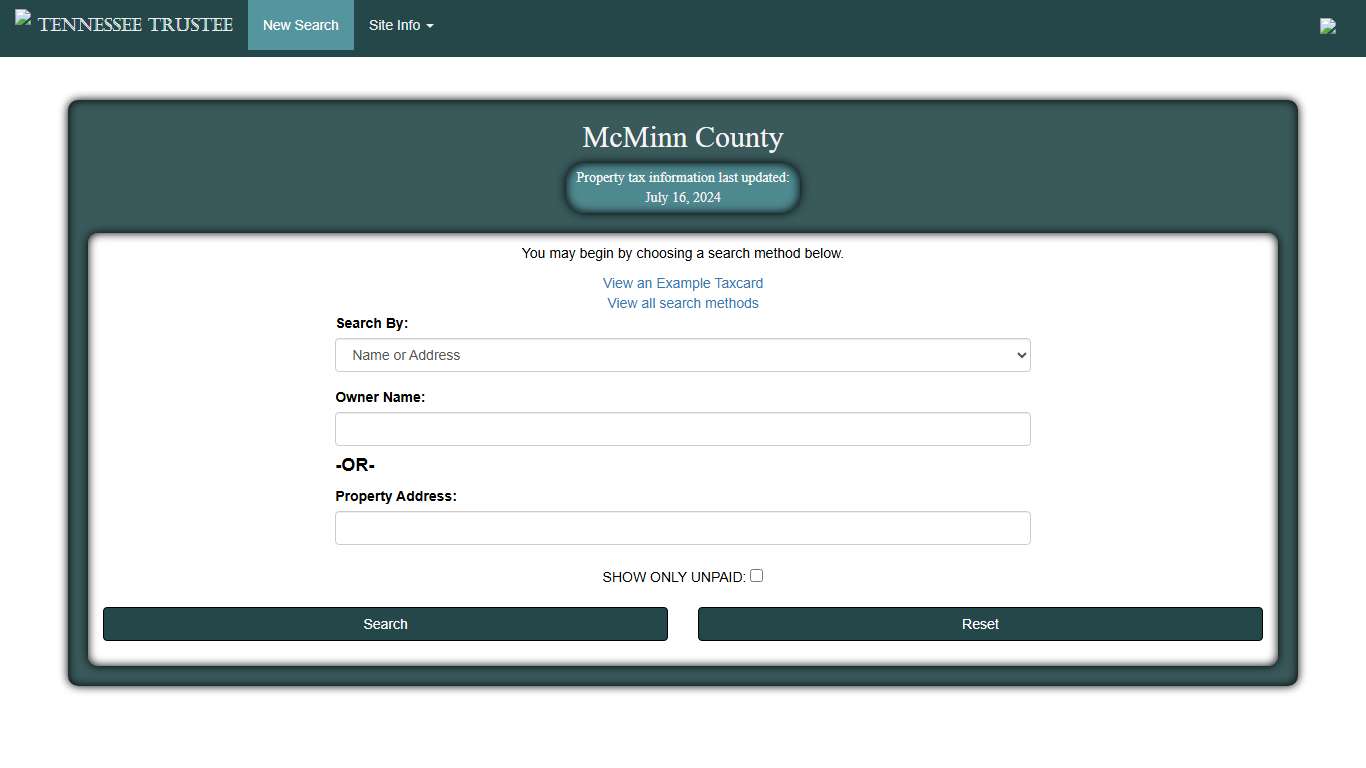

Tennessee Trustee

Welcome to the Tennessee City and County Trustee's Association Website The Tennessee Trustee's Association provides this website for the benefit of its members and the general public. Public Access includes a tax calculator tax search, online payments using credit cards and electronic checks, links to individual County Trustee websites, and FAQs.

https://tennesseetrustee.org/

Real Property Assessment Data

Real Property Assessment Data The Property Search works best in Google Chrome, Microsoft Edge or Mozilla Firefox. Google Chrome may not open PDF (Assessor Map) files. MS Edge may not display the property Sketch. The percent symbol (%) may be used as a wildcard.

https://www.washoecounty.gov/assessor/cama/?parid=53428202

Industrial Development Bonds

Industrial Development Bonds Industrial Development Bonds are tax-exempt Private Activity Bonds issued by the Industrial Development Bond Board of the County of McMinn (IDB) on behalf of manufacturing facilities to finance qualified capital projects. Tax-free bonds are available for new projects with investment up to $10 million.

https://www.makeitinmcminn.org/doing-business/local-incentives/p/item/2187/industrial-development-bonds

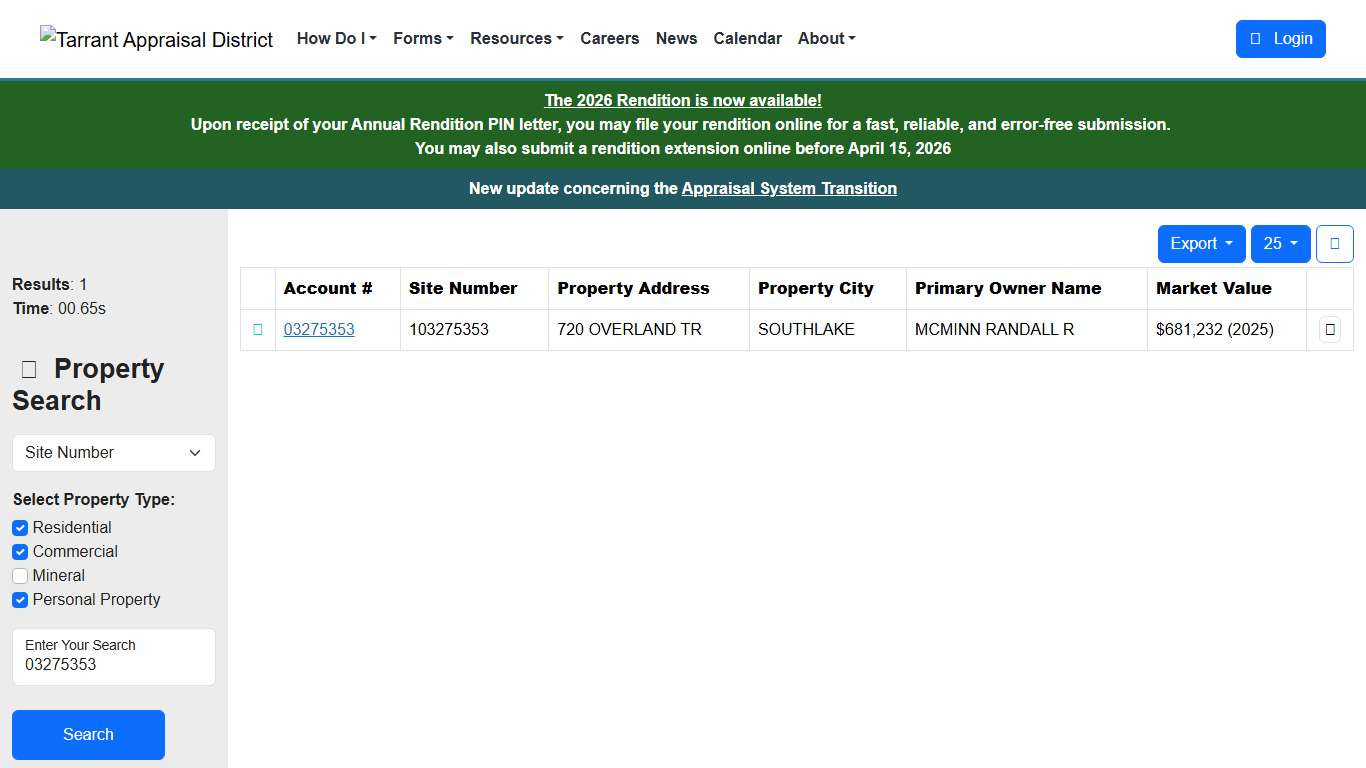

Property Search Results - Tarrant Appraisal District

Results: 1 Time: 00.65s Your session will expire due to inactivity in 2 minute(s). The 2026 Rendition is now available! Upon receipt of your Annual Rendition PIN letter, you may file your rendition online for a fast, reliable, and error-free submission. You may also submit a rendition extension online before April 15, 2026...

https://www.tad.org/search-results?searchType=SiteNumber&query=03275353